How Do You Make Money from Stocks?

One of the first questions every beginner asks is simple and practical:

How do people actually make money from stocks?

Is it by buying at low and selling at high?

Do stocks pay income?

Is it risky for a beginner?

In this article, you’ll learn the real ways an investors make money from stocks, explained clearly and honestly – without hype or jargon.

The Two Main Ways to Make Money from Stocks

There are two primary ways investors earn money from stocks:

1️⃣ Price appreciation (capital gains)

2️⃣ Dividends (income from profits)

Let’s understand both step by step.

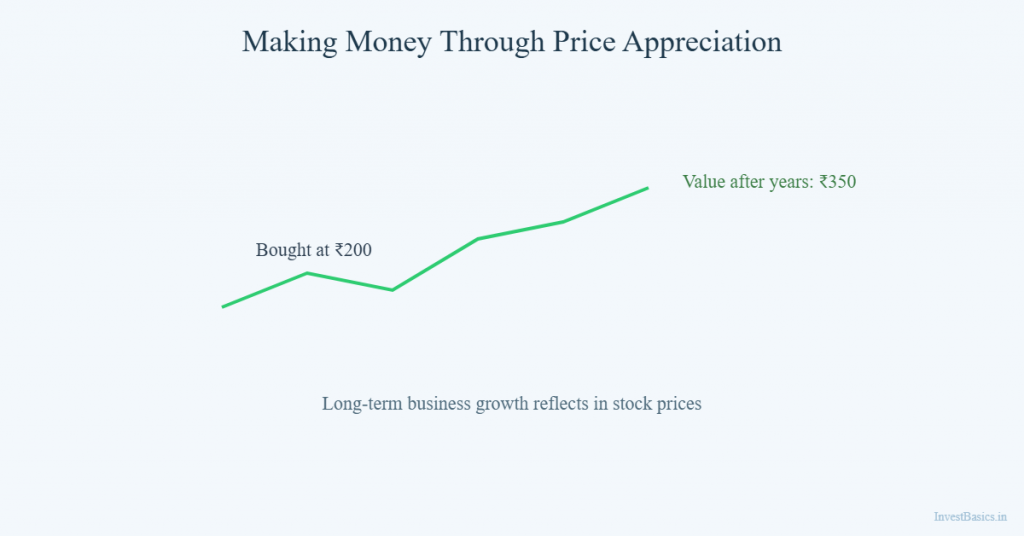

1️⃣ Making Money Through Price Appreciation

Price appreciation means your stock becomes more valuable over time.

Simple example:

- You buy a share at ₹200

- After a few years, the share price becomes ₹350

- The difference (₹150) is your gain (before tax)

This gain is realized when you sell the share.

Why Do Share Prices Increase?

Share prices rise when:

- Company profits grow

- Revenue increases

- Business expands

- Future prospects look strong

In the long term, good businesses tend to grow, and their share prices usually reflect that growth.

This is why long-term investing is so powerful.

Short-Term vs Long-Term Price Gains

Short-Term Gains

- Based on market movements

- Influenced by news and market sentiment

- More unpredictable

Long-Term Gains

- Driven by business performance

- More stable

- Less dependent on timing

Beginners are better suited for long-term investing, not short-term speculation.

2️⃣ Making Money Through Dividends

Dividends are payments made by companies to their shareholders from the company’s profits.

When a company earns profit, it can:

- Reinvest it in the business, or

- Share a portion with shareholders as dividends

If you own shares, you may receive dividends directly into your bank account.

Do All Companies Pay Dividends?

No.

- Mature, stable companies often pay dividends to their shareholders

- Growing companies usually reinvest profits

Both approaches are valid.

Some investors prefer:

- Dividend income for regular cash flow so they buy dividend paying stocks

Others prefer:

- Growth stocks for higher long-term appreciation they buy growth stocks

How Much Money Can You Make from Stocks?

This depends on:

- How long you stay invested in that stock

- Quality of companies you invest in

- Market conditions

- Your discipline and patience

There are no guaranteed returns, but historically, stocks have:

- Outperformed inflation

- Delivered strong long-term returns

Consistency matters more than trying to predict the market.

How Compounding Boosts Stock Returns

Compounding happens when:

- Your investments grow

- Gains remain invested

- Growth builds on previous growth

Over time, even small investments can grow significantly if it is left untouched.

This is why starting early matters more than starting big.

Do You Make Money Only When You Sell?

Not always.

You can:

- Earn dividends without selling

- Benefit from rising prices even if you don’t sell yet

However, price gains become real profits only when you sell.

Until then, gains are unrealized and can fluctuate.

Common Beginner Mistakes About Making Money from Stocks

❌ Expecting quick profits

❌ Trying to time the market

❌ Panicking during market falls

❌ Selling good stocks too early

Most losses happen due to behavior, not lack of opportunity.

How Long Does It Take to Make Money from Stocks?

There is no fixed timeline and you must keep this in mind.

However:

- Short-term results are very unpredictable because of volatility

- Long-term investing improves outcomes

Stock investing rewards:

- Patience

- Discipline

- Staying invested

Can Beginners Make Money from Stocks?

Yes—but not by copying traders or chasing tips.

Beginners do best when they:

- Learn basics

- Invest in strong businesses or diversified funds

- Stay invested long term

- Avoid emotional decisions and impulsive buying and selling

Slow, steady progress beats fast, risky moves, like the tortoise.

Stocks vs Other Income Sources

Stocks are:

- Not a salary

- Not fixed income

- Not guaranteed

They are a wealth-building tool, not a quick income replacement.

Using stocks for long-term goals works far better than expecting monthly profits.

Final Thoughts

People make money from stocks by:

- Owning growing businesses

- Staying invested long term

- Letting time and compounding work

Stocks are not about daily wins.

They are about participating in economic growth.

Once you understand this, investing becomes calmer and more purposeful.

What to Read Next

👉 Why Stock Prices Fall Even for Good Companies

🔑 Key Takeaway

You can make money from stocks through price growth and dividends.

Also, long-term investing reduces risk and improves outcomes.

Your patience matters more than perfect timing.