Why Market Volatility Is Normal (And Why Beginners Shouldn’t Fear It)

Have you ever looked at the stock market and seen prices going up and down every day? you may have wondered:

Why the market is so unstable?

Is this normal?

Should I be worried with this?

The short answer is: yes, volatility is normal—and beginners shouldn’t fear with this.

In this article, we’ll explain what market volatility means, why does it happen, and how beginners should think about it – in simple, calm language.

What is Market Volatility?

Market volatility refers to how much prices move up and down over a period of time. This means that market volatility is about the changes that happen in the market.

- Frequent price changes = higher volatility

- Smaller, slower changes = lower volatility

Volatility does not mean that something is wrong.

It simply means prices are reacting to new information.

Why Do Market Prices Move So Much?

Market prices change because investors constantly react to:

- Company earnings

- Economic data

- Interest rate changes

- Government policies

- Global events

- Investor emotions

Every day, many people make decisions while expecting about their future.

Then these changing expectations cause prices to move up and down.

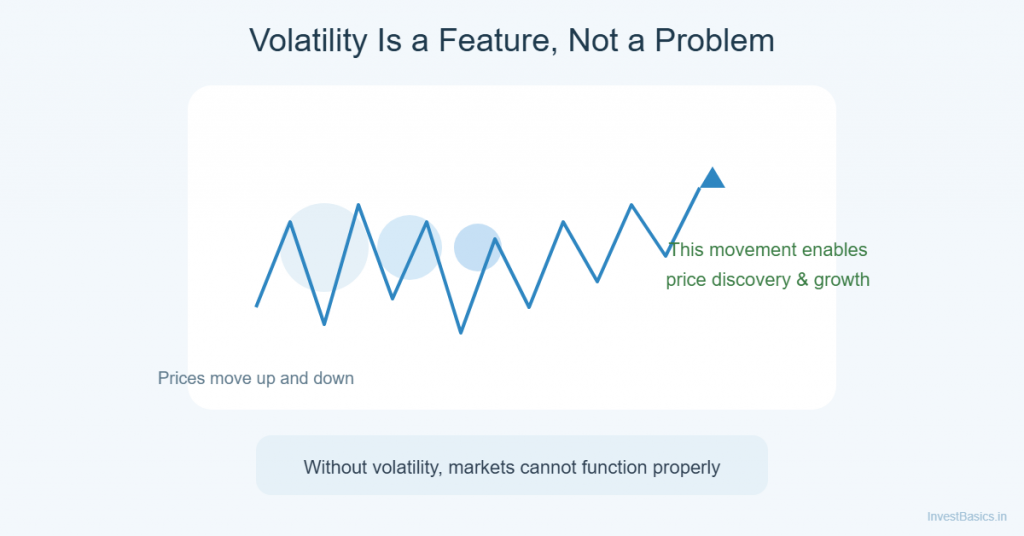

Volatility Is a Feature, Not a Problem

A lot of people who are new into investing usually think that volatility is a sign of danger. Volatility is something that can be scary for beginners. This can be a little frightening as well, for people who don’t know much about volatility.

In reality:

- Volatility is how markets function

- It reflects changing opinions and information

- It allows prices to adjust and stay fair

Without volatility:

- There would be no opportunity for growth

- Prices would not reflect reality

Volatility keeps the market alive and responsive.

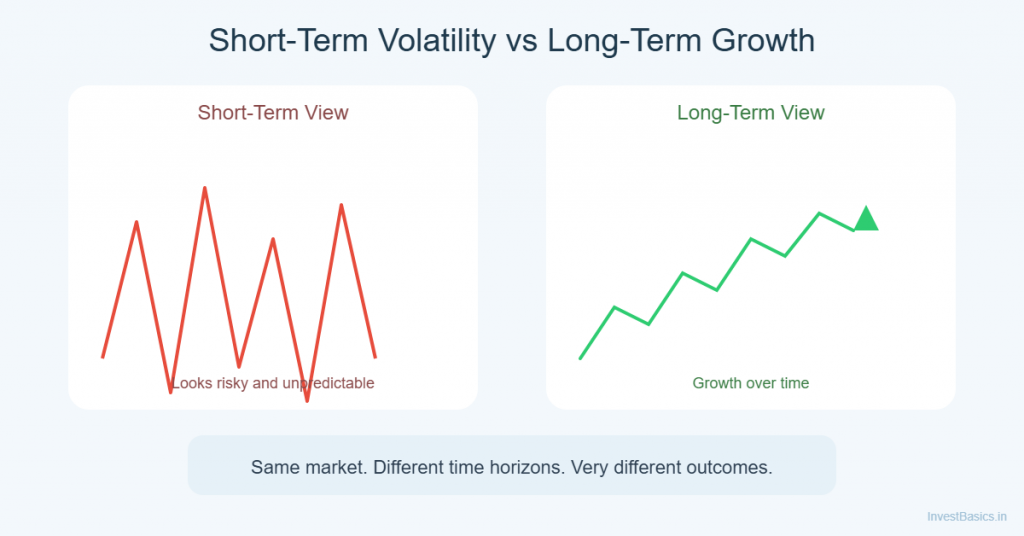

Short-Term Volatility vs. Long-Term Growth

This part is very important for people who are just starting out and who are in their initial phase of investing. The concept is something that all beginners need to understand.

Below is the key difference between short-term market ups and down and long-term growth

Short-Term View

- Prices fluctuate frequently

- News causes emotional reactions

- Movements feel unpredictable

Long-Term View

- Markets tend to grow with economic progress

- Short-term noise fades

- Business fundamentals matter more

Over long periods, what matters more? – growth matters more than daily movement.

Why Volatility Feels Scarier Than It Is?

Volatility feels scary because of those reasons:

- Losses actually feel more painful than gains

- Media focuses more on negative headlines

- Red numbers trigger emotional responses

But emotions exaggerate the impact of short-term movements.

Experienced investors who have been investing for a long time understand the concept of volatility they know the fact that “Temporary declines are part of the journey, not the end.”

How Does Volatility Affects Beginners?

For beginners, volatility can lead to:

- Panic selling

- Stopping SIPs

- Avoiding markets completely

These reactions often do more harm than volatility itself.

The biggest losses usually come from emotional decisions, not market movements.

Why Volatility Can Actually Help Long-Term Investors

This may sound surprising, but volatility can be beneficial.

When markets fall:

- Long-term investors can buy at lower prices

- SIP investors accumulate more units

- Future returns can improve

Volatility can create opportunities for those who stay invested for long term.

Volatility and SIP Investing

SIPs work well during volatile periods because:

- You invest regularly regardless of market level

- You automatically buy more when prices are low

- You don’t need to predict market direction

This is why volatility is not an enemy for disciplined investors—it’s part of the process.

How Beginners Should Respond to Volatility

A simple, healthy approach:

- Expect ups and downs are part of it

- Focus on long-term goals rather them short term approach

- Avoid daily price tracking

- Stick to your investment plan

Markets will fluctuate.

Your plan should not.

Volatility vs. Permanent Loss

It’s important to understand the difference between Volatility and permanent loss:

- Volatility = temporary price movement

- Permanent loss = if you sell at the wrong time

Long-term investors who stay invested often recover from volatility over long-term.

Those who panic and exit lock the losses.

Final Thoughts

Market volatility is often normal, expected, and also unavoidable but it does not mean that –

- The system is broken

- Investing doesn’t work

- You made a mistake

It means the market is doing what it’s supposed to do.

Once you accept volatility as part of investing, fear reduces—and discipline improves.

What to Read Next –

👉 How Diversification Helps Reduce Risk

🔑 Key Takeaway

Volatility is normal.

Emotional reactions cause more damage than price movements.

Long-term investors learn to live with the market ups and downs.