In our earlier Article about How Do You Make Money From Stocks We discussed that dividend is one of the ways to earn money through stock market.

So What Is a Dividend?

A dividend is a portion of a company’s profit that it shares with its shareholders. We can also say that dividend is a reward that a company gives to its shareholders.

Many beginner investors assume dividend as FD interest, but this is not the case. FD interest is guaranteed but dividend totally depends on company’s profitability and decisions.

In simple terms, when a company earns money and decides it does not need all of it for growth or expenses, it may distribute part of that profit to its owners (shareholders). This payment is called a dividend.

In India, dividends are usually paid in cash directly to your bank account, though sometimes companies may also issue bonus shares instead. We will talk about Bonus shares in another article.

How Dividends Work (Step-by-Step)

Step 1: Company Makes a Profit

A company runs its business and earns profits over a financial year.

Step 2: Company Decides to Share Profits

The company’s management may decide to keep some profit for future use and distribute the rest as dividends.

Step 3: Dividend Is Announced

The company announces:

- How much dividend will be paid

- Who is eligible to receive it

- When it will be paid

Step 4: Shareholders Receive the Dividend

If you own the company’s shares on the eligible date, the dividend amount is credited to your bank account.

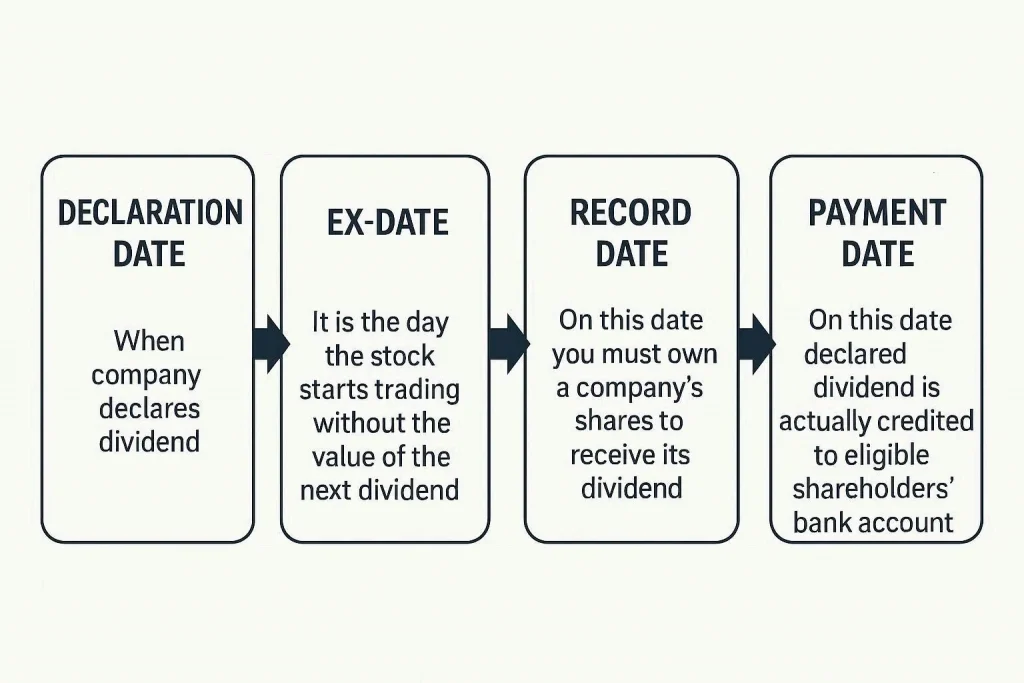

Important Dates About Dividends –

- Declaration date – When company declares dividend

- Ex-Date – It is the day the stock starts trading without the value of the next dividend

- Record Date – In this date you must own a company’s shares to receive its dividend

- Payment Date – In this date declared dividend is actually credited to eligible shareholders bank account

A Simple Example

Imagine a company declares a dividend of ₹5 per share.

- If you own 1 share, you receive ₹5 as dividend

- If you own 1000 shares, you receive ₹5000 as dividend

The dividend amount depends on:

- How many shares you own

- How much dividend the company declares

Why Do Companies Pay Dividends?

Companies may pay dividends for several reasons:

- They are generating steady profits

- They want to reward shareholders

- They do not need all profits for expansion

- They wants to attract stable investor

Not all companies pay dividends. Some companies prefer to reinvest those profits back into the business instead. We often call those companies as growth

Common Beginner Misconceptions About Dividends

“All companies pay dividends”

This is not true. Not every company pay dividends, especially growing ones, may not pay dividends at all.

“Dividends are guaranteed income”

Dividends are not guaranteed. A company can reduce, skip, or stop dividends it all depends on its financial situation.

“Higher dividends are always better”

A high dividend alone does not mean an investment is better. Dividends should be understood as one part of the overall picture. If company always pays high dividend there is a lack of growth reinvestment.

“Dividends are free money”

Dividends come from company profits. When a dividend is paid, the company’s value adjusts accordingly. Also, dividends are taxable and added to your total income. So you cannot consider dividend as free money.

Beginner Note:

Many new investors buy shares just before dividend announcements expecting easy income. In reality, the share price usually adjusts after dividends, so this strategy does not guarantee profit.

Practical Takeaway for Long-Term Thinking

Dividends show how investments can provide periodic income in addition to long-term growth. For long-term investors, understanding dividends helps build realistic expectations about how returns may come over time – slowly, steadily, and linked to business performance.

For a beginner, the most important takeaway is the concept of Reinvestment. So instead of spending your dividends, you can use them to buy more share of the company.

The key is to see dividends as a by-product of healthy businesses, not as something that happens automatically.

Conclusion

Dividends are simply a way companies share profits with shareholders. They are neither guaranteed nor automatic, but they play an important role in how investing works. By understanding dividends early, beginners can develop a clearer and calmer view of investing—focused on fundamentals rather than short-term noise.